Secure your financial future

while giving back to your community

POOLED INCOME FUND

Attention: all 401K, IRA, or pension plan account owners, it’s urgent that you act now! Consult your tax and financial advisors about our Pooled Income Fund (PIF) before December 31.

Our PIF works in this simple way:

1- You donate appreciated noncash assets to our PIF for which you get a substantial tax deduction that can offset a Roth exchange.

2- As income beneficiary(ies), you recieve total return of income from your portion of the PIF for life.

3- Upon the passing of all income beneficiaries, your portion of the PIF goes to endow the charitable project(s) you selected, including Donor Advised Funds

New! Route 664 radio station

Tune in all day long to great hits and conversations of kindness. Get inspired on the ‘Road to Human Kindness’ station throughout your day.

SOCIAL SECHARITY USES SECTION 664

to benefit you, your family and your community.

Social Secharity is a way to:

- Create more income to rely on

- Pay less tax

- Do something for your commmunity

Social Secharity may be the next generation’s Social Security!

It’s time to endow America

OVER 50 YEARS AGO CONGRESS ENACTED TAX CODE SECTION 664.

- (IRC Section) 529 is for funding Education

- (IRC Section) 401k is for funding Retirement

- (IRC SECTION) 664 is for funding Charitable and Personal Wealth

Social Secharity allows for the change from government funding social services to your favorite charities providing social services.

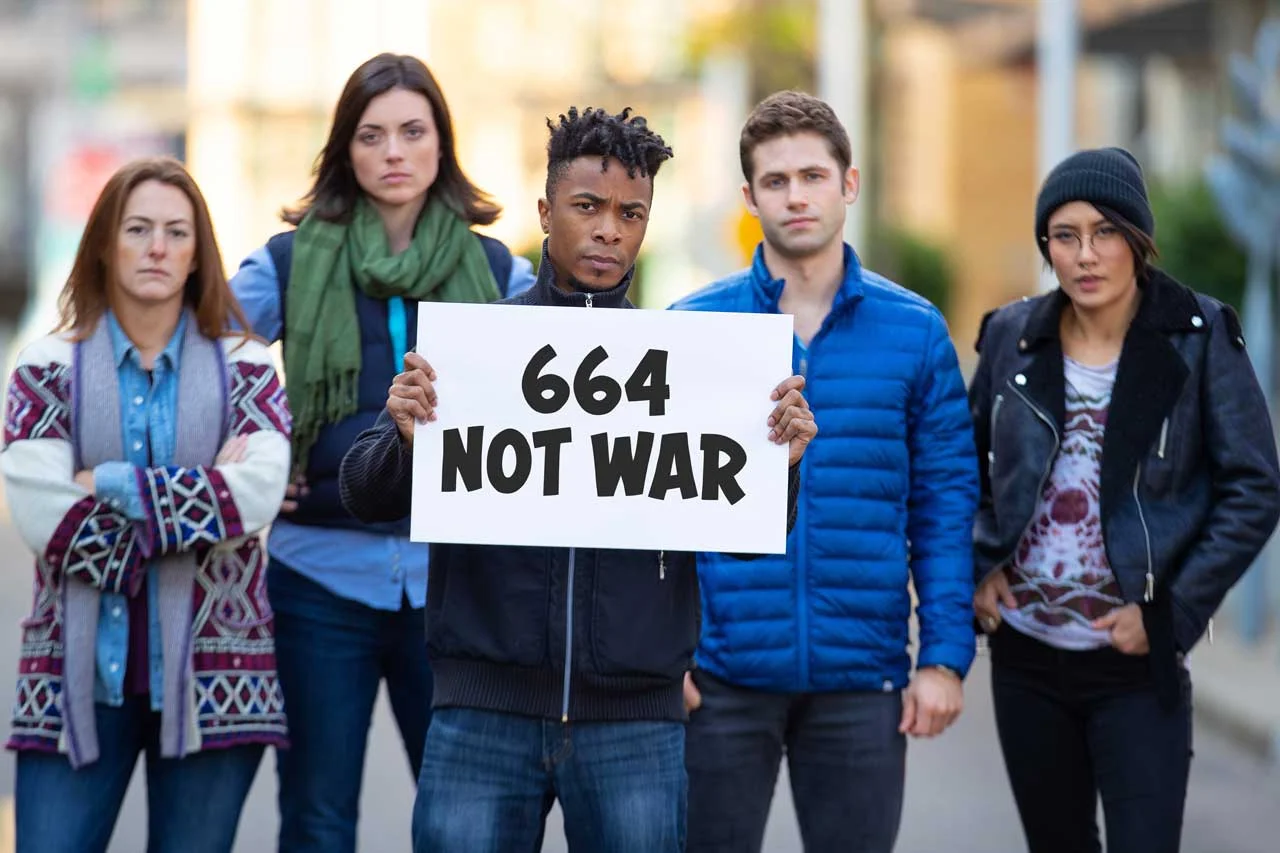

The slogan that explains how to make this change is “664 NOT WAR”.

Social Secharity Case Studies

Case Study 1

High income married young professionals under 45 use a multiple gifts to a Pooled Income Fund.

Case Study 2

Case Study 3

Married couple aged 70 uses their non-cash asset to create a Charitable Gift Annuity